Author: Harry Napier

Bitfinex: The Cryptocurrency Exchange

Bitfinex is a Hong Kong-based cryptocurrency exchange which was founded in the British Virgin Islands by iFinex Inc and started its operations around late 2012. The exchange was initially envisioned to be a peer-to-peer lending platform exclusive for Bitcoin investors and traders. Today, Bitfinex allows traders to exchange over fifty cryptocurrency pairs such as Ethereum, LiteCoin, and Ripple.

Bitfinex is known most notably for its extremely advanced interface and controversial past of security breaches and serious allegations.

However, Bitfinex provides quality services to its clients, offering margin trading and lending options, albeit its services are recommended to be undertaken by seasoned and expert traders.

Services

Trading Platform

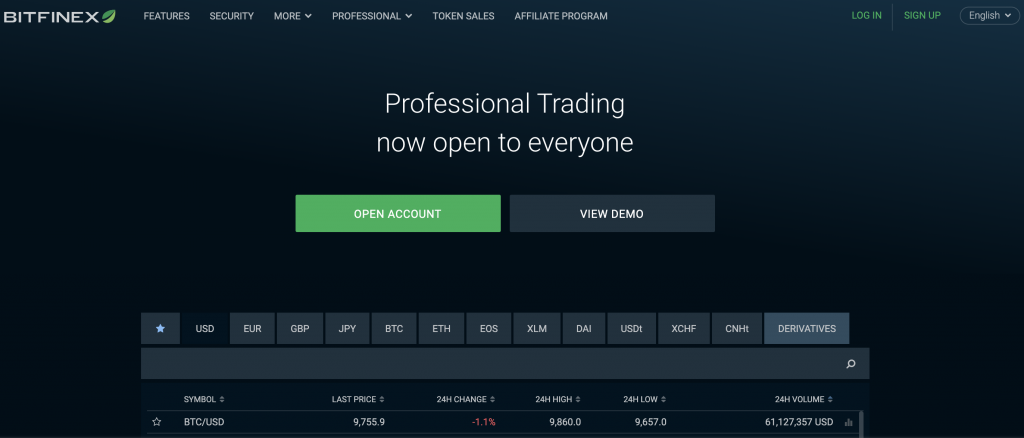

Bitfinex’s sophisticated and fully customizable exchange platform offers some of the most liquid financial instruments than most of its global competition.

In terms of the platform itself, the Bitfinex trading platform boasts a vast array of cutting-edge, customizable Graphical User Interface (GUI) that trades in over fifty cryptocurrency pairs such as BitCoin and Ethereum.

Bitfinex’s platform is also tooled with a large arrangement of convenient tools including and not withholding order types such as limit, market, stop, stop-limit, trailing stop, fill or kill, and scaled orders which traders may use with advantages that best suit their trading strategies.

As far as Bitfinex’s platform customizability and flexibility go, traders are also given access to state-of-the-art charting functionality and various Application Program Interface (API) services.

Overall, the Bitfinex trading platform combines convenience with customization, which can strike well with much more advanced cryptocurrency traders.

Crypto Services

Bitfinex’s services place a heavy focus on cryptocurrencies. As such, there are no fees for deposits from digital currencies and a highly competitive withdrawal fee for Bitcoin, LiteCoin, Ethereum, Zcash, Monero, Dash, Ripple, Iota, EOS and much, much more.

Margin Trading and Funding Options

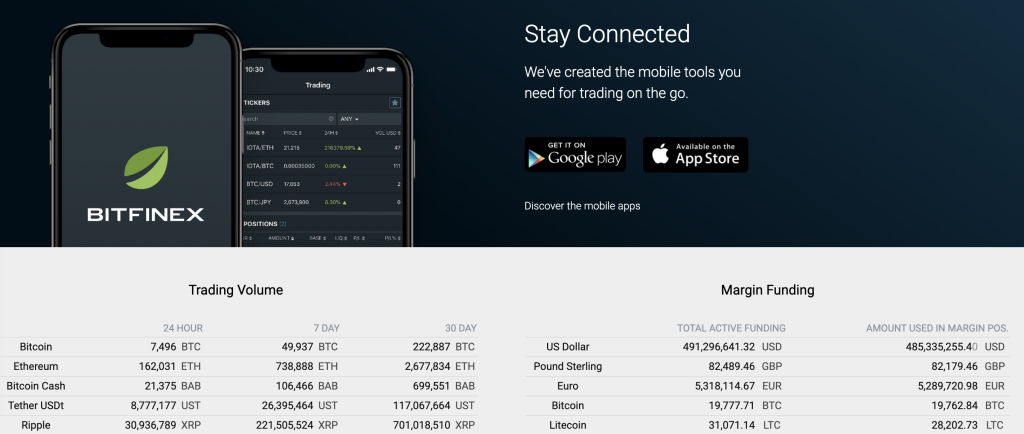

Bitfinex traders are viable to trade with a leverage level up to 3 times the amount when using the service’s peer-to-peer margin funding platform.

Furthermore, traders can also profit additionally by borrowing or lending their cryptocurrencies to and with other traders in a secured network.

Borrowing and lending details such as amount, duration, and interest can all be authorized by the trader or user through automatic services available in Bitfinex. In addition, traders can open funding offers to other of Bitfinex’s users and earn interest off of it.

Over the Counter (OTC) Services

Bitfinex also provides over-the-counter services to traders who would wish to trade much larger amounts like $100,000 worth of any cryptocurrency through private means.

Supported Countries

Bitfinex can extend its provided services all over the world. However, due to restraints on resources and the restrictions that govern other countries, Bitfinex is currently available on countries such as Bangladesh, Bolivia, Ecuador, Kyrgyzstan, and the United States of America.

Past Controversies

When it comes to company history, Bitfinex may probably be one of those stories that wouldn’t be held in high esteem. In fact, Bitfinex’s rocky past has seen itself in the spotlight for the worse.

An example would bring us back to 2015, where Bitfinex’s security and the platform were hacked, resulting in the theft of over 1,500 Bitcoins placing doubt on the exchange’s reliability.

In April of 2016, another hack resulted in another theft amounting to a whopping 120,000 Bitcoins gone under their noses. Many people considered this as one of the second-largest heists in history, dwarfed when compared to the loss of Mt. Gox’s 750,000 Bitcoins.

However, unlike Gox, Bitfinex took it upon themselves to spread its losses among other clients who were not affected by the hack. This meant that all of its clients had 36% of their total balance removed. This obviously angered a lot of its.

It was only a year later when Bitfinex decided to compensate only most of its premium clients.

This wasn’t the end, though – even more difficulties kept on piling on for Bitfinix. Again, in the next year of April 2017, Bitfinex’s bank accounts were temporarily frozen by its correspondent bank, Wells Fargo.

Bitfinex’s clients were all held in limbo as the situation pressed on for weeks, which led to many complications such as client complaints and major distortions in Bitfinex’s pricing. Service was finally restored a few months later, albeit at the cost of the United States and its consumer base banning Bitfinex due to the manner of how the company handled the situation.

Fees

Bitfinex makes use of a taker/maker fee model. This is where takers are people who place new limit orders, and makers are people who fulfill these orders created. Bitfinex fees can start 0.2% for takers while fees for larger makers get non-existing fees, dropping as low as 0% for orders made over the counter.

Bank wires have a 0.1% deposit and withdrawal fee, which can reach up to 1% if you’re looking for an expedited withdrawal.

Fees for cryptocurrencies transactions are generally free save for withdrawals or depositing less than $1,000 worth of digital assets. Fees for low deposits can vary depending on the type of cryptocurrency being deposited. Cryptocurrency transactions can also contain smaller fees depending on the type of currency being withdrawn.

For a piece of much more detailed information about Bitfinex’s fees, you can read more about it on their Bitfiniex.com website page.

Payment Methods

Also, Bitfinex accepts fiat deposits in EUR, GBP, and USD. However, these centralized currencies can only be deposited through wire transfer. Bitfinex also supports Tether (USDT), which is a quasi-fiat token that normally (and unofficially) pegged to the U.S. Dollar’s price. A cheaper method is crypto deposits, which possess little to no fees.

When it comes to Tether usage and withdrawals of expedited cryptocurrencies, Bitfinex would require for the user to provide e-mail verification. For direct access, Bitfinex supports it through the use of a Tor hidden service.

Reviews and Client Feedback

While Bitfinex does provide its users with decent service and knowledge-based information on its website, many criticize the exchange for its shoddy business history, and many leading review sites do give it a “below average” rating. There are also concerns from most of its clients who claim that Bitfinex always seems to be “hiding something,” and later, in 2018, New York’s attorney general accused the exchange of a coverup amounting to $850 million.

Bitfinex denied the claims, later sending an open letter to its users a day after. As of now, no one knows if there was some truth to these allegations not.

Conclusion

While Bitfinex does provide a decent service for trading large amounts of digital coins, it isn’t very forgiving for newer clients who have just got into trading cryptocurrencies. The lack of convenient deposit methods, complicated interface, and poor company history can deter most potential clients away.

While it may be a safer bet to check out other exchanges like Coinmama and CEX.io, experienced users may find what they’re looking for in Bitfinex. As for its history of security breaches, some may conclude that the past attacks merely aided in strengthening Bitfinex’s security systems.

Whatever it may be, it is up to the trader to decide.