The best cryptocurrency brokers in Canada

Below is a breakdown of some of the best brokers who allow cryptocurrency investments, including BitCoin. Unfortunately though, due to legal reasons, brokerage firms and traders from the province of Québec are not permitted to trade:

Canada’s official draft for trading Cryptocurrency regulations and how BitCoin rose in popularity

As other countries globally open their doors to the ever-growing appeal of digital currency trading and services, Canada has come out of the fray and joined the trend by publishing its own draft regarding its stance toward Cryptocurrency and the brokers and traders that deal with them.

The regulations of this draft were published back in the summer of 2018 through the Canada Gazette.

In the draft’s release, it detailed and brought to light the problems that the Financial Action Task Force (FATF) took note of during its very first evaluation between 2015 and 2016. This was back when Cryptocurrency was relatively new to the masses, and many were not aware of the advantages and benefits that came with both investing in it and the technologies it would bring about in the future.

The chief issue that the FATF pointed out mainly regarded the violation of money-laundering and terrorist-financing laws.

These points, though valid, oversaw a detail. The detail is that the published draft saw the exchange of Cryptocurrency and its services as a Money Service Business (MSB). Any entity or firm under the MSB category were required to report all of its transactions that topped CAD 10,000 (USD7,700).

Moreover, traders are unable to trade above $1,000 without providing identity information due to the Know Your Customer policy KYC.

The view of Cryptocurrency by the Central Banks

Later on, in the winter of 2017, President of the Central Bank of Canada, Stephen S. Poloz, publicly warned against virtual currencies, especially BitCoin.

In her statement, she claimed that Cryptocurrency could not be considered as money.

Despite her disclaimer of the Cryptocurrency as a financial instrument, BitCoin still found its way and surged in popularity in Canada. Just between 2016 and 2017, the number of BitCoin investors jumped from 2.9% to 5.0%.

This puzzled officials at the Central Bank of Canada and would later perform a study that would take up two years to finally understand how to regulate the usage and knowledge of BitCoin in Northern America.

The increasing number of Bitcoin Investors

BitCoin’s value and regulations are very volatile in the sense that its uses and purposes keep changing. Back in 2016, newfound technology and the currency aspect of Cryptocurrency were the main purposes of trading. People were more fascinated by the technology rather than its value, while others focused on how it acted as a second form of currency. Of all the people who traded BitCoin, only a small fraction (12% of the total people) were primarily investing in it.

However, in 2017, the direction shifted from an interest in BitCoin’s Blockchain technology, and a heavier emphasis was on actual investors. This change in pace can be attributed to the extraordinary skyrocketing BitCoin’s value nearing December 2017.

BitCoin trading from a banking perspective

Before, as every other major bank and financial institution imposed restrictions and barriers for traders of Cryptocurrency, Canada’s largest bank, the Bank of Montreal, followed suit.

This paved the way for the Bank of Montreal to be brought to the spotlight after internals of the bank were leaked onto Reddit in April 2017. According to the details, the Bank of Montreal had reportedly been stonewalling its customers from making any transactions that involved Cryptocurrency such as BitCoin to “better protect the security of their customers and the bank.”

In other cases, Scotiabank and the Toronto Dominion Bank had also reportedly restricted its customers from making such transactions with the reasons that the trading of BitCoin “could expose them to much higher debt levels than they can repay.”

Why banks and financial institutions pry people away

from Cryptocurrency

The actions of banks are not only isolated in Canada. Many financial groups, including CitiGroup, Commonwealth Bank, and Danske Bank, have also been taking dire action against the purchase of cryptocurrencies and penalizing its customers for it, prematurely freezing a user’s account with any warning beforehand.

Fortunately, this method backfired – in Canada, at least and proved to be in vain. Instead, traders shifted their focus from using banks and moved to forums, websites, or e-Wallets for their purchases of Crypto.

This basically opened doors for websites such as Localbitcoins to flourish under the authoritative rule of the central banks.

The later outlook of BitCoin and Cryptocurrency

While many companies possess their view about BitCoin and its uses, there is an equally large number of companies that support it. Companies like the TMX Group, for example, have created its service for the exchange and purchase of Cryptocurrencies.

The complex and advanced Blockchain technology that Cryptos use has been seen favorably by the Canadian government and has employed the help of the World Economy Forum to create an ID system called Traveller Digital Identity that makes use of the Blockchain technology. By the start of 2018, the National Research of Council of Canada would announce its attempts to administer the technology with its own Ethereum for transparent administration of government orders.

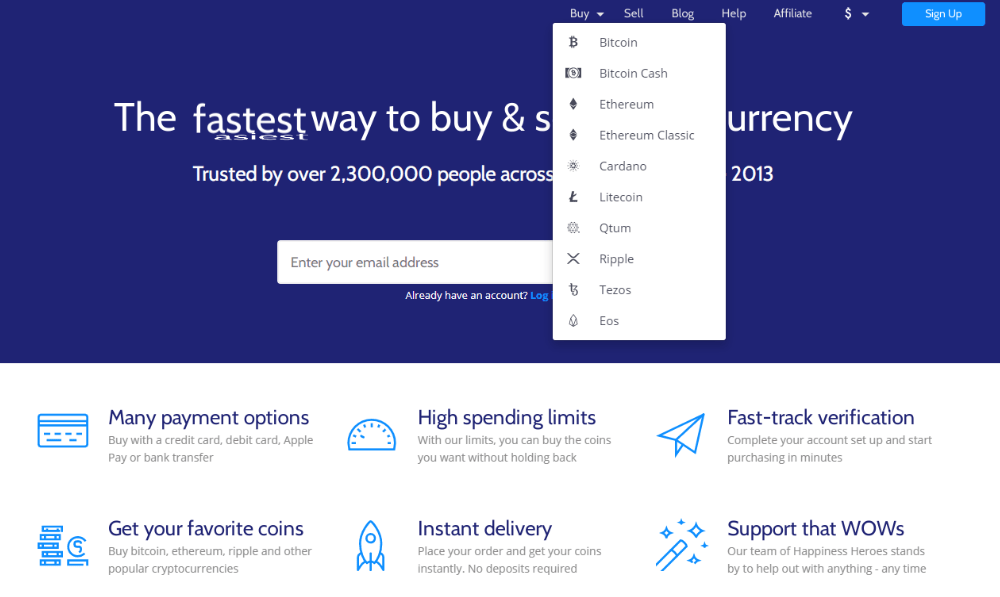

Canada cryptocurrency brokers list

-

Binance Exchange

ReviewRegulation: Swedish FSA

Min. Deposit: 200 US$

Max. Leverage: 1:30 | 1:100

Trading Platforms: Currenex, cTrader, MT4 -

Beaxy Crypto

ReviewRegulation: Swedish FSA

Min. Deposit: 100 US$

Max. Leverage: 1:30 | 1:100

Trading Platforms: Currenex, cTrader, MT4 -

Bitbuy crypto

ReviewRegulation: Swedish FSA

Min. Deposit: 100 US$

Max. Leverage: 1:30 | 1:100

Trading Platforms: Currenex, cTrader, MT4 -

Coinberry review

ReviewRegulation: CySEC, BVI

Min. Deposit: 10 US$

Leverage: 1:100

Platforms: NetTradeX, MT5 -

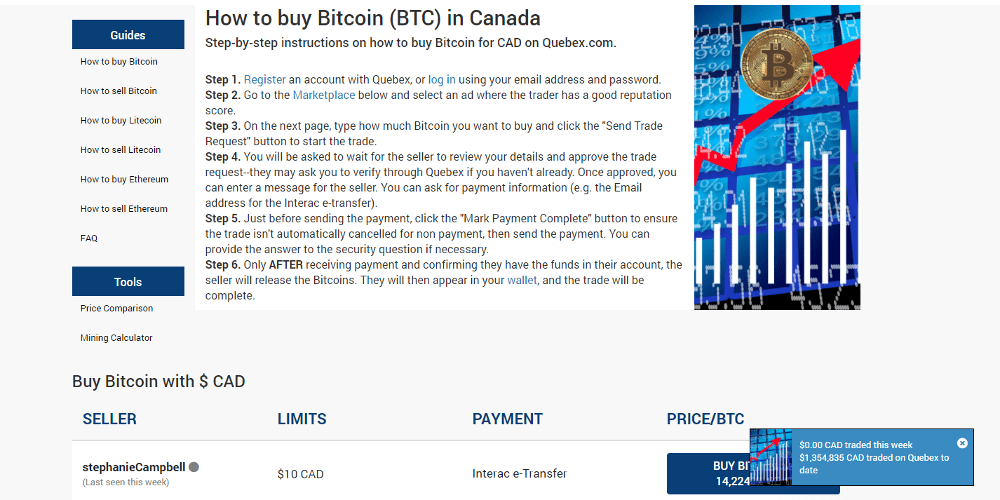

Quebex review

ReviewRegulation: CySEC,FCA,ASIC

Min. Deposit: $/€/£ 50

Leverage: 1:500

Spreads: Low as 0.1 pips -

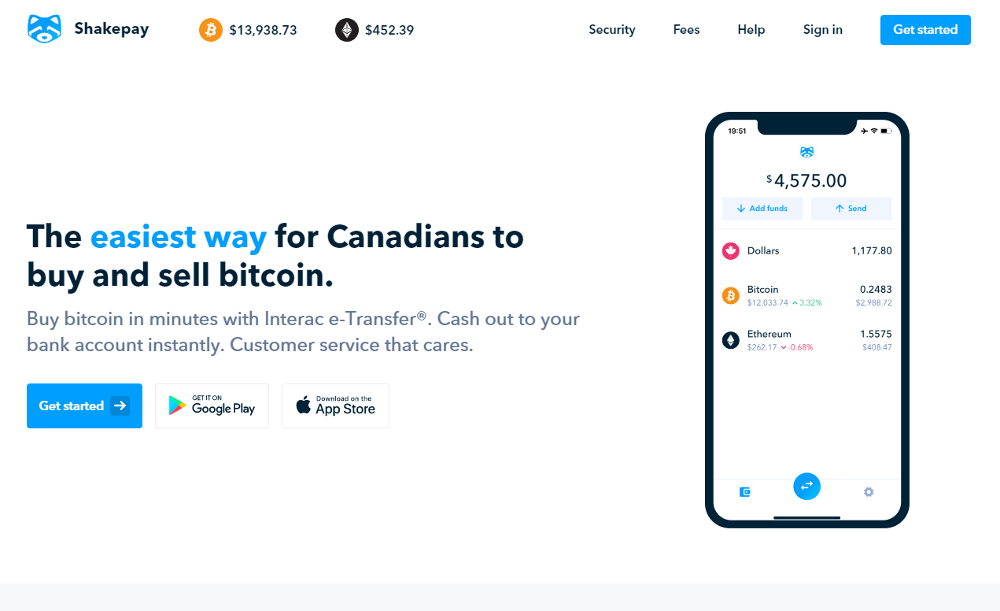

Shakepay review

ReviewRegulation: FSP

Min. Deposit: 100 US$

Max. Leverage: 1:500

Trading Platforms: MT4 -

Bitit review

ReviewRegulation: KYC, CySEC

Min. Deposit: 10$

Leverage: 1:150

Platforms: MT5 -

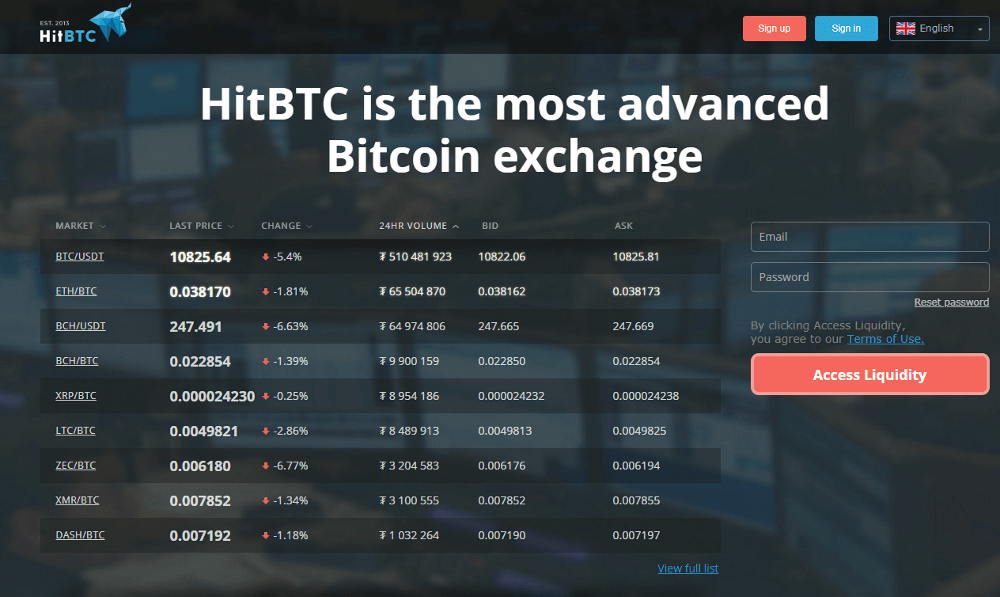

HitBTC Review

ReviewRegulation: KYC, AML

Min. Deposit: 1.5 EUR

Leverage: 1:50

Platforms: MT4, MT5 -

Coinmama Review

ReviewRegulation: CySEC

Min. Deposit: 100 US$

Max. Leverage: 1:30 | 1:500

Trading Platforms: MT4 -

Mercatox review

ReviewRegulation: FSP

Min. Deposit: 500 US$

Max. Leverage: 1:1000

Trading Platforms: MT4. MT5 -

Coinjar Review

ReviewRegulation: ASIC, CySEC

Min. Deposit: $/€/£ 300

Leverage: 1:200

Spreads: Ultra Tight from 0.0 pips -

Paxful Review

ReviewRegulation: Swedish FSA

Min. Deposit: 10,000 US$

Max. Leverage: 1:30 | 1:100

Trading Platforms: Currenex, cTrader, MT4 -

Luno Review

ReviewRegulation: FSP

Min. Deposit: 100 US$

Max. Leverage: 1:500

Trading Platforms: MT4 -

Poloniex Review

ReviewRegulation: CySEC

Min. Deposit: 100 US$

Max. Leverage: 1:30 | 1:500

Trading Platforms: MT4 -

CoinSpot Review

ReviewRegulation: CySEC

Min. Deposit: 1000 US$

Max. Leverage: 1:20 | 1:100

Trading Platforms: MT4, MT5 -

OKCoin Review

ReviewRegulation: KYC, CySEC

Min. Deposit: 10$

Leverage: 1:150

Platforms: MT5 -

OKEx Review

ReviewMin. Deposit: 500 US$ Max. Leverage: 1:1000 Trading Platforms: MT4. MT5 Regulation: FSP -

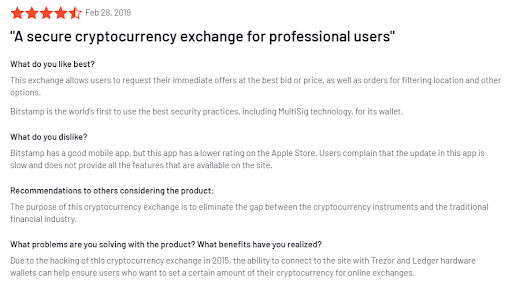

Bitstamp Review

ReviewRegulation: ASIC, CySEC

Min. Deposit: $/€/£ 300

Leverage: 1:200

Spreads: Ultra Tight from 0.0 pips -

BitMEX Review

ReviewRegulation: ASIC, CySEC

Min. Deposit: $/€/£ 100

Leverage: 1:500

Spreads: Ultra Tight from 0.0 pips -

Kraken Review

ReviewMin. Deposit: 100 US$

Max. Leverage: 1:500

Trading Platforms: MT4

Regulation: FSP -

BITTREX Review

ReviewRegulation: Swedish FSA

Min. Deposit: 10,000 US$

Max. Leverage: 1:30 | 1:100

Trading Platforms: Currenex, cTrader, MT4 -

Bitfinex Review

ReviewMax. Leverage: 1:200

Min. Deposit: 200 US$

Trading Platforms: MT4, MT5

Regulation: FMA -

TRADE99 Review

ReviewRegulation: CySEC

Min. Deposit: 100 US$

Max. Leverage: 1:30 | 1:500

Trading Platforms: MT4