Author: Harry Napier

BitMEX: A Cryptocurrency Trading Firm Not to be Taken Lightly

A portmanteau for Bitcoin Mercantile Exchange, BitMEX, is a Cryptocurrency exchanging firm that allows margin trading services. Allotted for both experienced and novice BTC traders, the buying and selling of contracts for Cryptocurrencies–not the actual coin–are permitted alongside leverages.

Important to note, despite BitMex accounts for the supplement of contracts for different digital currencies, with deposits and withdrawals, it only works for Bitcoin.

With that said, one must tread carefully once the choice is made in enlisting the services of the firm. As this is the case, experienced Bitcoin traders are at an advantage here.

BitMEX was founded by a mixture of individuals specializing in the financial field, the trading industry, and the web development discipline. In 2014, the idea that had been incepted by professionals, Arthur Hayes, Ben Delo, and Samuel Reed, had finally found materialization. BitMex was initially set up under their company HDR Global Trading Ltd, within Victoria Seychelles.

What BitMEX is All About

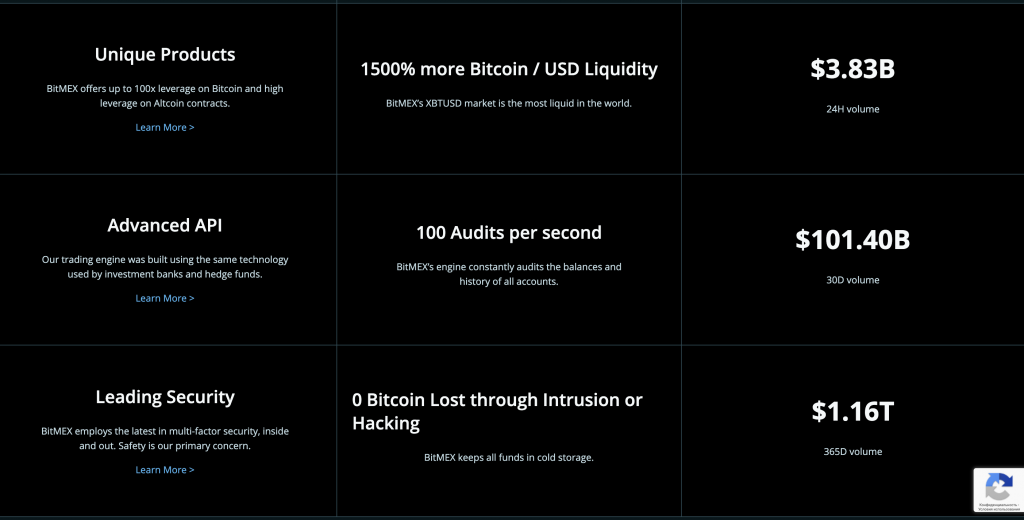

BitMEX’s business focuses mainly on margin trading, for it supplies a derivative exchange platform. What this entails is not the trading of Cryptocurrencies, but the contracts following the set price for a Cryptocurrency. Trade in this kind of system can be leveraged up to 100x.

Worthy of note, this trading classification is highly volatile. Such proves advantageous for BitMEX users as it can produce large profits through the spending of only a morsel of the traders’ actual earnings. But of course, this may also go the other way as one can easily lose money quickly.

What BitMEX poses should be taken with a grain of salt, especially if you are not an experienced trader. While the warning is made, this feature does not, in any way, discourage anyone who might be a novice who is altogether interested in BitMEX. What this is saying is that a more experienced individual in the field of trading has an edge compared to one who doesn’t have tenure.

So if you are nettled with what has been said previously, let the rest of the discussion help you out in breaking the specifics down.

Offerings

First off, let us take a look at what BitMEX offers:

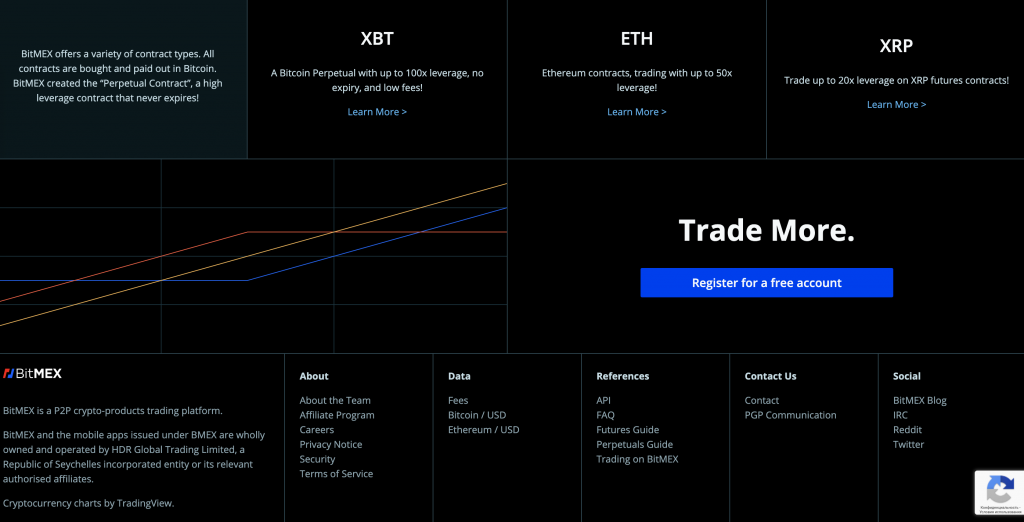

- Future Contracts

A deal to either buy or sell a digital currency at a pre-set price at a definite time in the future.

- Perpetual Contracts

This type of contract is not different from the Futures Contract. The only departure from it is that it doesn’t expire or doesn’t have a settlement.

- Upside Profit Contracts

Here buyers are permitted to take part in a Cryptocurrency’s potential upside. In this system, the buyer purchases a premium on trade date for which he is qualified for the receipt of the difference between the price of the digital currency and strike on the maturity date, should it be positive. That is should no other payment occur.

- Downside Profit Contract

Put, this is the exact opposite of an Upside profit Contract. Buyers are let in on the potential downside of digital currency.

Coins of Value for BitMEX

And while BitMEX has BTC as its primary trading coin option, their clients are allowed access to a wide selection of altcoins which includes:

- Bitcoin Cash

- Cardano

- EOS

- Ethereum

- Litecoin

- Tron

- Ripple

Trades with Bitcoin bear both Spot and Futures trading options. All the other currencies only have Futures markets.

At present, one must be informed that BitMEX has no support for fiat currency. The exchange is only conducive to Bitcoin. What this tells us is that both profits and losses are displayed for Bitcoin despite working with altcoins. As this is the case, deposits and withdrawals can only be executed in Bitcoins.

Competitive Fees

BitMEX takes pride in its competitive fees. If you are a diligent trader, you wouldn’t even mind these fees as your ventures will only turn out handsome profits.

The taker fee is set at 0.0750%. The Maker fee, possibly at -0.0250%. This means that the maker gets only a small amount of rebate on trades.

One would be thrilled to know that deposits and withdrawals remain to be free. No hidden costs are left to be resolved when you are finished with trading.

What we are driving at here is that the fees that BitMEX has to make it appealing for traders to grab the opportunity of signing up with the firm.

International Coverage

The Republic of Seychelles recognizes BitMEX as a legitimate entity. As a registered firm under the republic it is poised as a global company with an expansive reach–save for the following countries:

- Crimea

- Cuba

- Iran

- North Korea

- United States of America

- Province of Québec in Canada

- Sevastopol

- Sudan

- Syria

While the exchange is not hampered by any limits on access for any areas, (in light of its nature of catering to Cryptocurrency) local laws still play an important part in the usage of service.

Support and Transparency

Email tickets are the main means for support in BitMEX. This is standard across all trading exchange platforms and brokerage firms in the present era.

Noteworthy of BitMEX’s comprehensive service is its website. The site is full of purposeful information and useful implements that users can make the most of to understand the firm’s advocacy. The site effectively educates its users into becoming more efficient traders.

The site is also filled with up-to-date information regarding its tools’ updates and possible issues.

An interesting and helpful feature of BitMEX’s site called a Trollbox. This is a live chat function that permits inquirers to send messages to other Bitcoin traders to get a pulse on what may be good trading decisions.

On top of that, BitMEX also practices transparency by disclosing security information on the website itself. The firm makes its users privy to the owner of the website and what kind of measures they take to secure their funds.

Security

BitMEX also has a multi-signature system for withdrawals. Efficient and makes funds wholly safe for all users; only partners would be able to sign for access. Additionally, the firm also has cold storage and Amazon Web Services that furthers the security.

As Margin trading is not mainstream (meaning it is not understood by the masses), only a few reviews are out on the worldwide web regarding BitMEX. As this is the case, negative reviews are but few to none.

There is a downside for U.S. traders. BitMEX does not accept them. While this is the case, in-depth verification processes are absent from BitMEX’s system.

Legitimacy and Legality

With all that has been discussed, the question one should be asking is:

Is BitMEX legal?

Most definitely. There is such confidence in the answer as BitMEX is completely owned by HDR Global Trading Limited. This corporation, with the company number of 148707, was incorporated under the provisions of the International Business Companies Act of 1994 as constituted by the Republic of Seychelles.

To reiterate, the conditions set here are all amicable to already experienced traders. This is so as BitMEX specializes in margin trading, something that the less-versed might find confusing. As this is the case, a beginning trader is advised to research further and build his or her trading portfolio further prior to signing up with the likes of BitMEX.