Author: Harry Napier

RoboForex Forex broker review: Content and Controversies

Brokers are hard to catch doing something specifically indecent, because it’s very easy for them to disguise manipulating and other fraudulent actions. So, it’s up to your guts to understand whether it’s worth trading with them or not.

The other reason why catching them can be complicated is because reviews left by the everyday users clash with one another and indicate complete opposite behaviors. Some claim the support is outstanding, the others – that it’s rubbish.

It’s often because they don’t do their dirty things all the time, and it’s irregular. The same goes to RoboForex – they are seemingly decent, but you’ll dig just a little below the surface, you’ll find a lot of dirt.

What is RoboForex?

Contrary to the name, their main shtick is not automated trading using robots. They do, however, have some very commendable qualities that would otherwise make for a very good broker.

Their trading goods list includes such categories as:

- Stock – that is to say, the shares that belong to big companies all over the world

- Forex – currency trading pairs that include money issues by most global economies

- Indices – indexes that reflect the ever-changing values of global economies

- Commodities – the category includes common resources, energy resources and precious metals unified respectively into ‘commodity’, ‘energy’ and ‘metal’ categories

- ETFs – less volatile portfolios of many stocks collected with care

- Cryptocurrencies – naturally, you can’t go anywhere without Bitcoin

- Cryptoindices – an intriguing new type of assets, these assets reflect the well-being of the crypto market as a whole

These instruments combine hundreds and even thousands of assets, all to accommodate the needs of any trader that comes by RoboForex. It’s actually a very decent collection, and trading here would be a very good experience, if not for the regularly occurring fraudulent actions.

But before that, let’s talk about the account types available here.

Account types

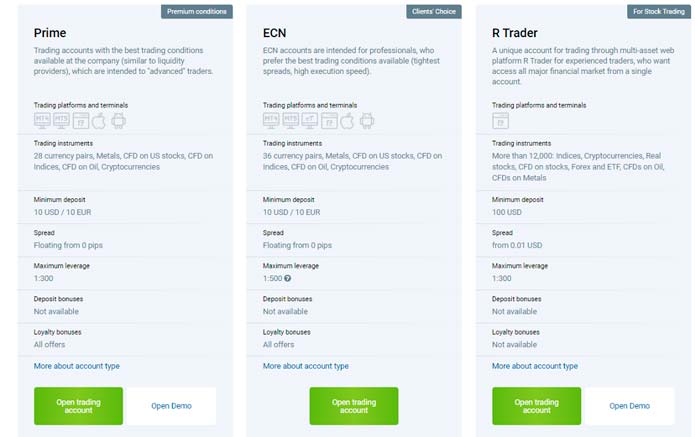

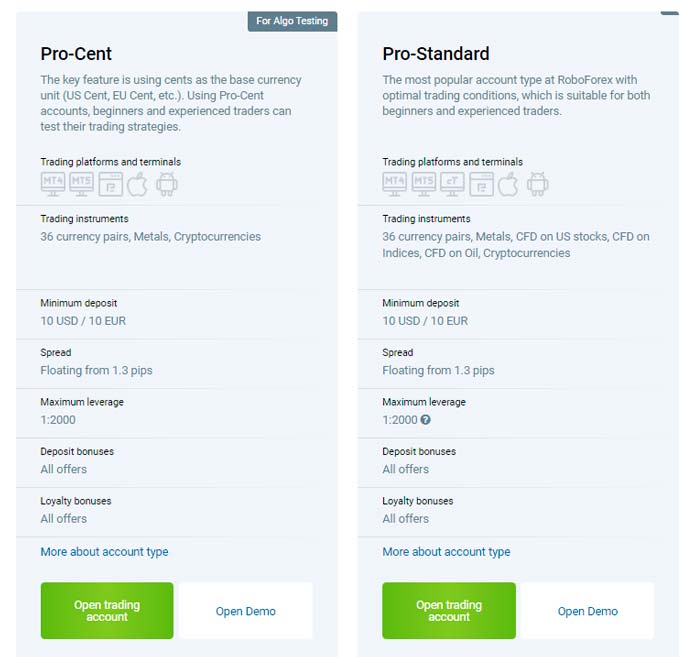

There are five main types of trading accounts. Progressively enough, the main difference is not the varying access to trading tools and instruments (although yes, some of them have a more restricted access to things like trading pairs and other assets).

Different types affect the way you pay for your trading. The exact distinctions can be seen on a dedicated page, and it’s better to look at it if you want a clearer picture of RoboForex.

But the abridged version is this: the spreads, commissions and the order volume is what changes significantly. The available payment currencies (and resources, in some cases) as well as the available asset types is what changes on a minor scale.

There are 5 of them, including:

- Prime

- ECN

- R-Trader

- Cent

- Standard

The bottom line is that they don’t change very much, and the existing variations are mostly there to give certain groups of traders (like the professionals, the beginners or strictly stock traders) playground room for their own capabilities.

For instance, serious professionals would enjoy the R-Trader deal that gives you the largest access to assets but also demands higher minimal deposits. In short, you can choose your own deal based on your own needs. The variety is focused here, and the aim is to get as many people aboard as possible.

Under different circumstances, it would be a commendable and innocent focus, because it both gives the broker more users and gives users more room for initiative, creativity and general effectiveness.

And while it may be so, their fraudulent episodes actually make this look like a malevolent desire to get as many victims as possible.

The Problems

The user rating of RF varies from website to website, but there are recurring issues. They are a complicated company, and most likely a fraud. Still, they frequently act like a good-natured broker with a nice customer support and decent trading mechanisms.

There are two aspects that often refuse to work properly, be that because of scamming or something else entirely.

- Trading manipulation

There are a lot of stories of unhappy RF users who came to trade here and ended up losing a lot of money because of some very fishy market behavior. For instance, it’s uncommon to lose your money here because the spreads suddenly spiked and the broker simply didn’t enact stop-loss in time.

It’s just one of the many examples, but you get the jig. While it is very fishy and these things do happen all the time, it’s the same ‘hard to catch’ thing as in the beginning of the article.

You will likely lose some (or all) of your money while trading here, but it’s unclear if it’s the preplanned fraud or just sub-par algorithm execution (or other technical problems).

Most people are convinced it’s the fraud because of the second problem

- Withdrawing issues

It’s actually a classic. Many people find that an otherwise helpful customer support suddenly turns unresponsive and unhelpful whenever you lose your money is a fishy way. Even if you contact them, they won’t be able to help – all very suspicious.

Furthermore, if you’d like to withdraw the remaining portion of your funds from the broker (after the incident or even without it), the chances are high that you won’t be given your money back under one of the usual pretexts.

In conclusion

If you elect to trade here, you’ll have to be careful and not invest a lot of money at the same time, because it apparently gets very tempting for the provider in question to run away with your funds. It requires no effort whatsoever, you’ll likely never catch them. Only they know the whole picture.

It’s probably fraud, but even if it’s purely technical – you’re still losing your money. So, it’s better to avoid RoboForex.